Variable expenses are those expenses that you incur several times per month, and at varying costs examples of variable expenses would be buying groceries, eating out, going to the movies, shopping for new shoes, hosting a wine-tasting party, etc.

FREE BUSINESS MONTHLY EXPENSES CHART HOW TO

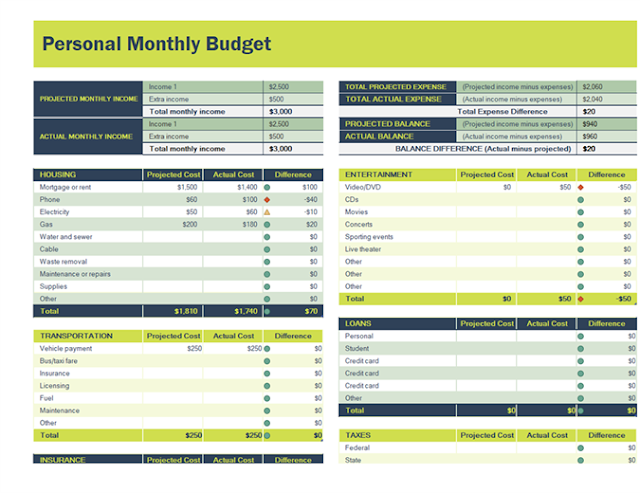

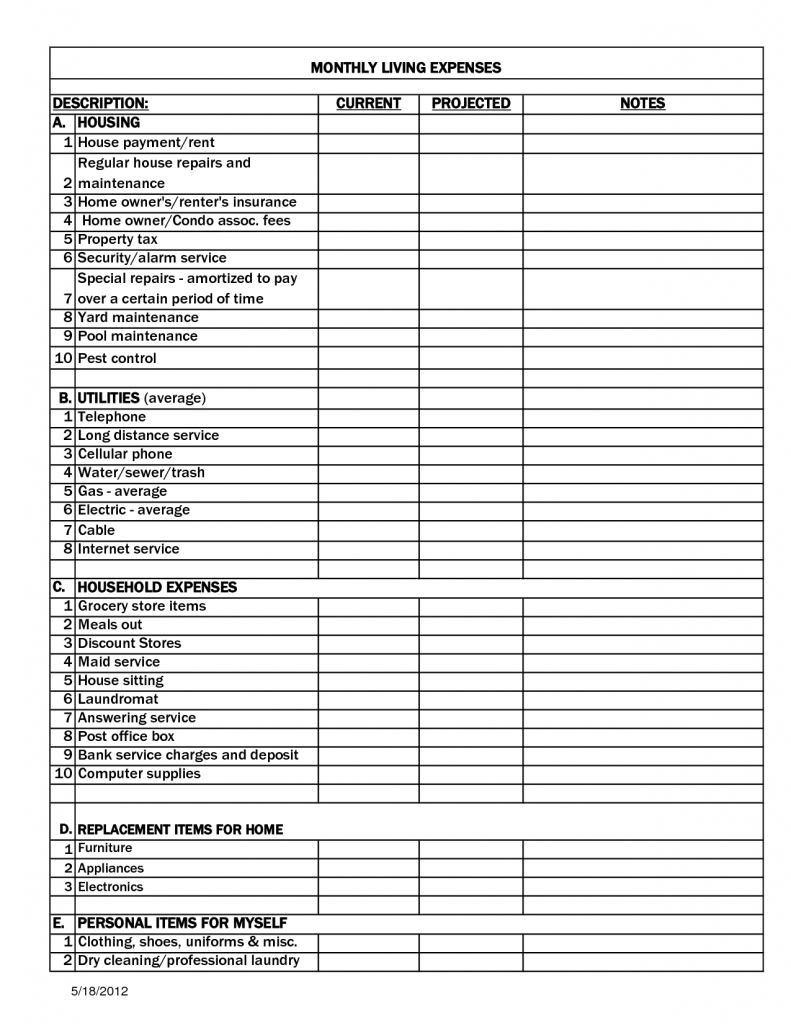

🔥 HOT TIP! Find out what the “big three” expenses are + how to reduce them (and save tons of money!) What are variable expenses? Try and write down an average payment for these utility categories once you really start paying attention and recording your spending, you can average the data out over time. Note: while expenses such as gas and electric may fluctuate by a small margin from one month to the next, they are still considered relatively fixed as they are paid once per month. You will only enter ONE number for each of the fixed cost categories. Therefore, for this example, you would write “$100” in the fixed cost column for car insurance. To calculate the monthly cost for those fixed expenses you will first take the amount that you typically pay (let’s say, $600 of car insurance) and divide the cost by the number of months it covers (a six-month time period). In some instances, fixed costs may be paid in one or two lump payments each year - this is typically the case for bills such as property taxes (one lump sum per year) or car insurance (paid every six months or so). What are fixed budget expenses?įixed expenses are expenses that are paid once per month at roughly the same cost examples of fixed expenses would be mortgage, rent, insurance, property taxes, phone bills, etc I know you’re excited to get started, but before we dive headfirst into tracking your spending, let’s discuss the difference between fixed and variable expenses. UPDATE: This budgeting printable helped us pay off $250,000 of debt and buy our dream home in Europe – watch our new home tour! (Don’t forget to subscribe!) Fixed versus variable expenses Help you hit all your money goals and CRUSH debt!.Plan your monthly budget for the future.Notice patterns of overspending so you can correct them.Easily write down day-to-day expenses for 30-days.Track spending across two primary budget expense categories (fixed & variable).Customize expense categories tailored to your specific needs.

FREE BUSINESS MONTHLY EXPENSES CHART PDF

Now, you could simply pick up a notebook and start jotting your spending - but why do that when you could just download an awesome free monthly expense tracker PDF printable? This monthly spending tracker will help you: That’s why the first step in creating a budget should be to track monthly expenses. Knowing where your money is going is one of the first key steps to taking control of your finances - a keen awareness of where your dollars and cents are being funneled each month will help you better manage your money in the future!Īfter all, how do you know how could you possibly know how much money you are saving if you don’t know how much you are spending? Turns out the same thing can happen to your budget! You know how you put off cleaning for a few days, then maybe a few weeks, and then suddenly you look around and your house looks like a bad episode of Hoarders? The Free Printable Monthly Expense Tracker that will revolutionize your budget

0 kommentar(er)

0 kommentar(er)